Why Do Mortgage Interest Rates Really Matter?

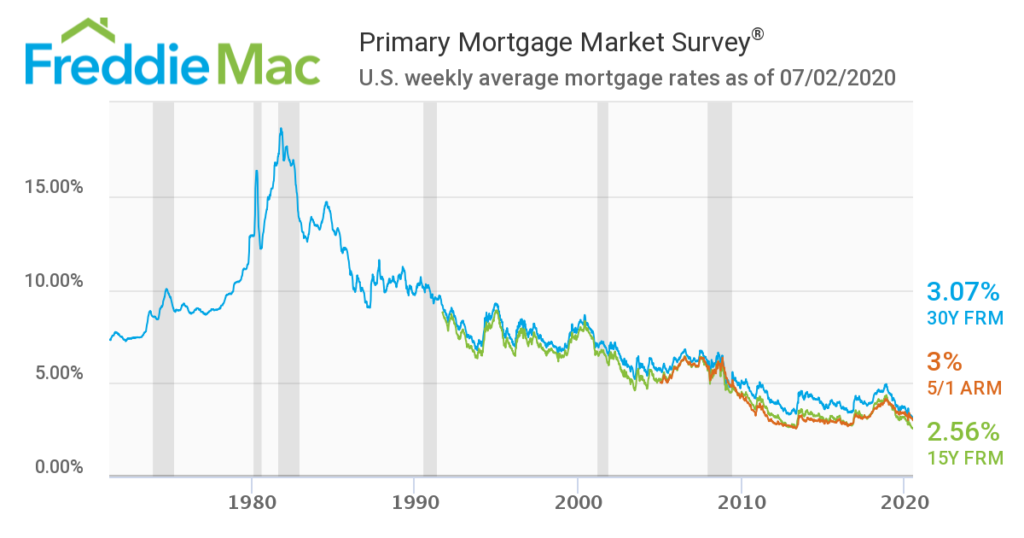

Interest rates are at historical lows right now. People within the real estate industry are mentioning how it’s a great time to buy a home because of this. Everyone assumes low interest rates obviously save you money on your monthly payment and how much you pay in the long run, but do you know how significant it really is? I’m going to breakdown some examples on how much interest rates really affect your mortgage.

I must first bring up the difference between interest rates and annual percentage rate (APR). The interest rate is the annual cost of a loan for a borrower. The APR the annual cost of a loan for a borrower WITH fees such as mortgage insurance, most closing costs, discount points and loan origination fees. Please keep both numbers in mind when looking to finance with different lenders.

As you can see in the chart below, it shows that we are definitely at record lows for mortgage rates. So, let’s compare how this can change your mortgage with some easy numbers.

EXAMPLES

I will exclude PMI and property taxes for the examples.

Mortgage: $500,000 (0% down)

Today’s APR: 2.9%

Monthly Payment: $2081

Mortgage: $500,000 (0% down)

October 3rd, 1980 APR: 13.6%

Monthly Payment: $5766

Now of course this is a drastic drop in interest rates, but a great demonstration on how big of a difference the interest rate can really make. Let’s look at a more realistic example. Many people want to wait to see what the market is going to do and interest rates may increase, here’s what may happen if rates increase while they’re waiting:

Mortgage: $500,000 (0% down)

July 25th, 2019 APR: 3.75%

Monthly Payment: $2316

From an APR of 2.9% to 3.75% you’ll notice a monthly payment change of over $200. That’s definitely a noticeable monthly difference for most homeowners and can affect whether someone qualifies for the loan or not based on their debt-to-income ratio.

Now let’s look at the long term benefits of a lower interest rate. Using an amortization schedule calculator, you can easily figure out what the long term difference will be for the loan. Let’s use the same numbers:

Mortgage: $500,000 (0% down)

30 year loan

Today’s APR: 2.9%

Total Payments: $749,214

Total Interest: $249,214

Mortgage: $500,000 (0% down)

30 year loan

October 3rd, 1980 APR: 13.6%

Total Payments: $2,075,913

Total Interest: $1,575,913

Mortgage: $500,000 (0% down)

30 year loan

July 25th, 2019 APR: 3.75%

Total Payments: $833,608

Total Interest: $333,608

If comparing from today’s interest rate to the same month last year, you’ll notice the total interest paid over the life of the loan is still a large difference of $84,394.

I hope by breaking down some of these numbers, it will help explain why so many people stress the importance of taking advantage of low interest rates. If you have any questions or would like to discuss more numbers, feel free to contact me anytime!